Fintech apps are booming tremendously since the global pandemic and there are 5000+ fintech companies emerging worldwide. Numerous advantages of financial technologies include efficiency gains and reduced transaction costs due to which Fintech software applications are growing in demand.

According to research, the size of the global fintech industry is projected to reach up to $324 billion by 2026, growing at a CAGR of about 25.18% between 2022 and 2027.

The COVID-19 outbreak spurred financial services and banking technology usage. Consumers used fintech applications to monitor their spending, send money, create bank accounts or invest throughout the pandemic.

But, the bulk of clients don't have faith in fintech businesses, which makes it even harder to gain popularity and be successful. Lack of confidence typically results from ignorance, concerns about data protection, and a dearth of rules. Hence, you must establish fintech credibility in order to draw customers and generate income. In this article let us explore some of the fintech app design tips to gain user user trust.

How can UX design be used to increase User Confidence in Fintech Applications?

20% of participants in a survey conducted by Mastercard expressed a high mistrust of fintech companies. Hence, it’s essential to adhere to the finest fintech app ux design practices while developing a mobile application.

In this piece, we’ll discuss five astute UX design for fintech suggestions for banking apps that can help you build client trust.

1. Onboarding Fintech Users

Particularly in comparison to conventional banks, the fintech industry is still young and doesn't enjoy the same degree of trust and reputation as established financial companies. As a result, many customers mightn’t be acquainted with ideas like automatic financial services, tailored products, peer-to-peer payments, and bitcoin exchanges.

Companies must produce educational material in this respect to educate clients and boost confidence in fintech. Onboarding lessons must be included for this reason, but they must be kept brief, understandable, and interesting. UX professionals can incorporate writings and videos that illustrate how the product will perform if it has complicated features.

Designing on-demand training materials like FAQs as well as tutorials is a good idea so that people can quickly comprehend a fintech solution. In addition, a business should use clear language while maintaining industry jargon.

Also, Read: How to Increase User Engagement on Your Mobile App

2. Utilize Surveys to gather Consumer Feedback

The utilization of sophisticated machine learning techniques and algorithms to comprehend customers and provide them with estimates based on current behavioral traits has generated a lot of excitement in the financial industry.

Another way to gather user insights is through user experience surveys. Polls are helpful and provide tips for fintech mobile app developers, analysts, and software developers swiftly get large-scale input, whether used for the open-ended information collection or verifying and measuring with sufficient numbers.

Several methods of prediction are used to give people the impression that they're working with individualized items, which are made to meet their particular requirements. Even the evaluation of enormous volumes of information in real-time that provides users with fast updates is made possible by machine learning.

3. Be Open and Honest about how you Acquire, Share, and Protect your Data

Enabling clarity regarding information sharing is crucial for building credibility with fintech customers and making users feel confident about giving their data. Most clients would choose improved openness and more authority over the data gathered by financial software solutions, including:

- Revealing the facts that are accessible to outside entities.

- Descriptions of the access that is permitted by the conditions of use of a financial offering.

- Notification of any potential dangers related to using a fintech app.

- The ability to decide what information and bank account third parties can access.

- The capability of a software system to regulate data access privileges.

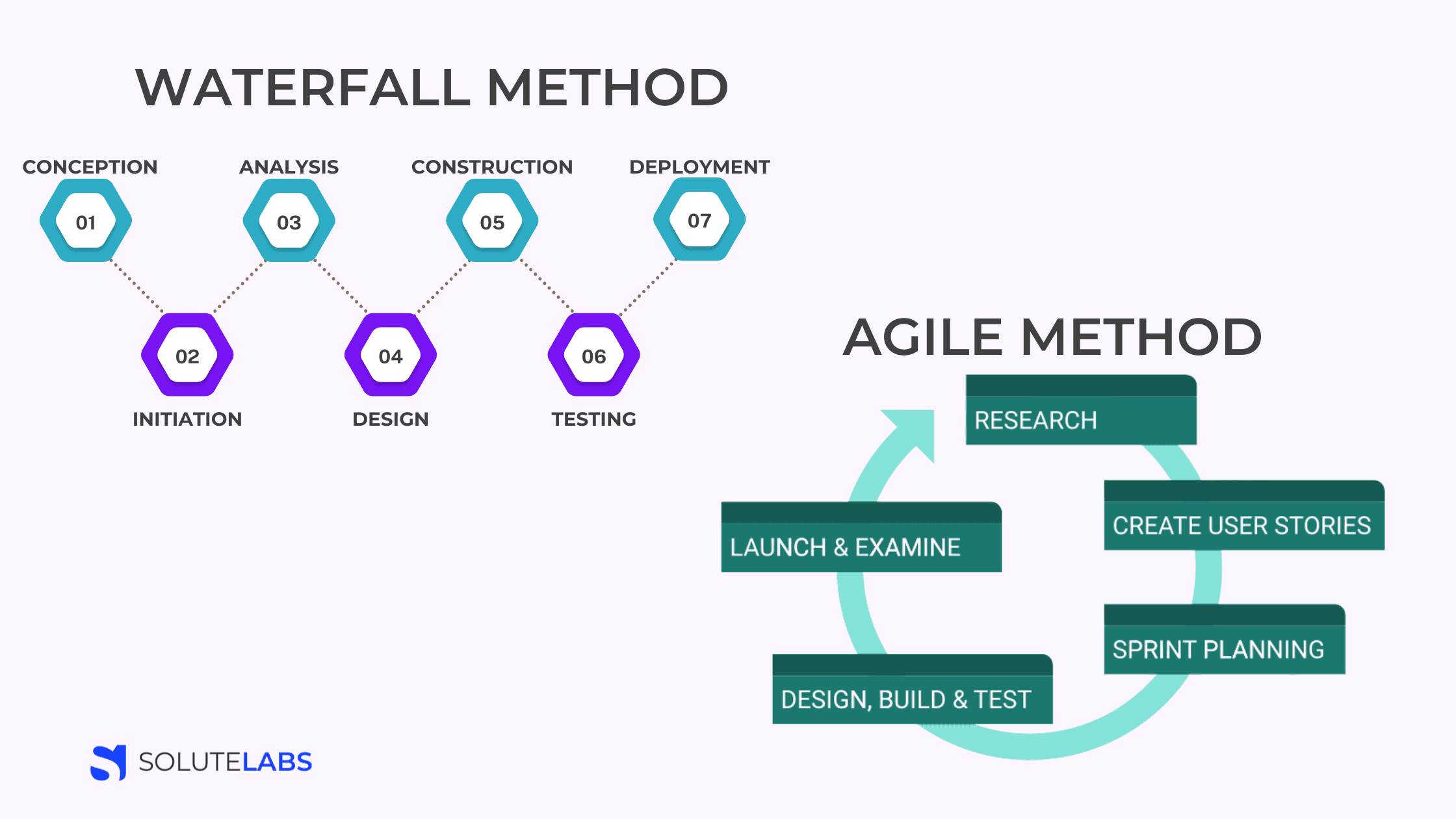

Agile fintech apps must explicitly request user authorization each time a payment gateway seeks a user's information in order to protect the confidentiality of data. It's critical to provide clear justifications for the sort of information you have to gather or why, in addition to who’ll be granted information access and why, in order to foster trust in the fintech industry.

You must also make clear the benefits of providing you with the data, such as obtaining personalized advice, determining an insurance policy, or building an investment strategy, as fintech companies require keeping and analyzing a significant amount of confidential data.

Fintech companies must create digital banking applications that provide users with a sense of protection while protecting their personal information. Delivering capabilities including two-factor identification, password protection, and speech matching detection is crucial for this goal, and it's also important to show people this commitment in the application and the online webpage.

Companies should use biometrics—the identification of facial structures, fingerprints, or behavior—so that fintech clients may register for software applications within a fraction of a minute and boost customer confidence while maintaining data protection.

To immediately notify consumers about possibly suspicious transactions, illegal access, or other questionable behaviors, fintech must render alerts automatic by design. Although turning on alerts is generally disliked by users of other types of products, it increases security and improves user experience in online banking systems, fostering client trust.

Also Read: How Does Agile Work With UX Design?

4. Employ Fintech Trust Indicators

Organizations must showcase their accomplishments, journal articles, third-party evaluations, customer reviews, credentials, and certifications in order to build confidence in the fintech space. Companies in financial technology must highlight their successes and advantages, including the user base, recognized nations, and regions where the product is available.

Prior to the introduction of a fintech solution, grammar must be scrutinized to ensure appropriate localization into several languages.

Businesses must make pricing transparent to gain the trust of fintech clientele. When utilizing software, consumers don't want to incur additional fees. It's essential to describe the entire product cost, the capability it offers, and the charges levied to clients in order to reduce misunderstandings.

When putting it on the application, online site, and in-store displays, organizations also must emphasize their unique selling point. Additionally, fintech app designs must show users the benefits of their product in figures. The application, for instance, enables users to save 12 hours a month on financial management, and a robot-advisory tool boosts income by 25% when matched with individual asset management.

5. Use essential UX Design Components

It's crucial to design the application with a user-friendly layout so that users really connect to the platform and also don't find the method of providing information burdensome. To assist users in achieving the objectives set for them, incorporate the UX components listed below.

1. Visuals and flow

To bring life to a boring topic like fintech, it's essential to invest in striking images and visuals. For example, you can choose to employ graphs, diagrams, and schematics in the fiscal dashboards rather than simply showing numbers to consumers — so that they may readily comprehend the information and macroeconomic variables of their current finances.

Without needing to contact their wealth manager or bank, it will make it easier for your customers to understand the information.

2. Microcopy and copy

Each piece of text contained in the app is covered by copy and microcopy. No matter their level of financial knowledge or experience, everybody should be capable of comprehending the content of the app.

Your FinTech application should be created using simple language which is free of complexity and sophisticated phrases because economics already is a tough topic. Even if there are some difficult concepts, such as Loan-to-Value (LTV) calculation or insolvency, discover ways to communicate them to consumers without adding an excessive amount of content to the interface. Do not forget to use a conversational style.

3. Content adaptation and device display

When creating fintech applications, flexibility is a crucial component. To ensure a pleasant user experience on every screen resolution, all information and data that consumers anticipate receiving should fit comfortably onto any display.

The ability to display a significant amount of information in big tables, including stats, forecasts, financial reports, and the like is yet another differentiating factor.

Customers should have the ability to simply explore and understand these statistics and documents if they are placed on a monitor and arranged in a manner that doesn't overburden people. They ought to be rationally constructed, legible, and expandable.

4. Gamification

Although the financial sector has an image of being severe and professional, your application can nevertheless incorporate some humor into the user experience. Gamification can assist you in lowering the obstacle to entry for financial apps and improving the app's user experience.

Gamification components will make transactions more enjoyable for customers and improve their overall user experience.

Also, Read: 10 Fintech App Ideas to Build Fintech Startups

Generate Fintech trust by creating a Secure Application and abiding by top UX Design Guidelines

In order to facilitate users' ability to locate the required information, it is critical to create a user-friendly interface and offer fluid browsing.

Focus on elements like safety, availability, adaptability, and reliable app execution while guaranteeing adherence to the necessary industry norms. Produce a design, which will cause users to become fascinated with your business by following design standards and staying current with the latest trends.

We at SoluteLabs offer the best fintech app development solutions to finance companies and are well aware that an efficient UI/UX design has a crucial role in the fintech app success. Get in touch with our experts to find the right solution for your fintech app requirements.